In 2025, more than half of the $8 billion equity raise for Delaware statutory trust programs was contributed to DSTs that have granted fair market value (FMV) options to the operating partnership of a real estate investment trust. Many hundreds of millions more of equity were raised for DSTs that[...]

How to Assess Fair Market Value/721 Options in DST Programs

Filed Under: 1031 Exchange, DSTs, 721s

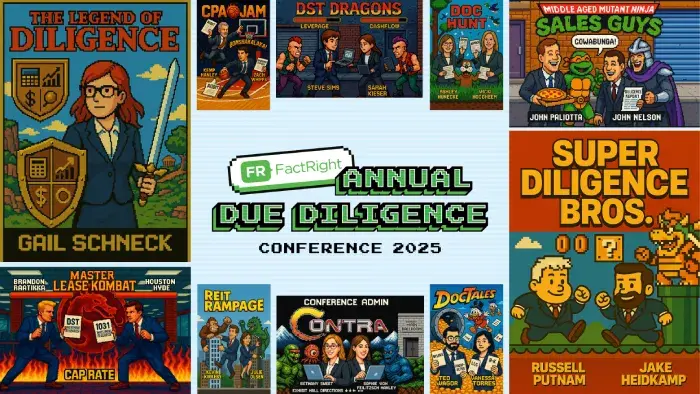

FactRight Names Jacob Heidkamp and Russell Putnam Co-CEOs to Drive Next Phase of Growth; Gail Schneck Retires

FactRight, a leading provider of alternative investment due diligence and risk management solutions, has named FactRight executives Jacob Heidkamp and Russell Putnam as co-CEOs to guide the next phase of growth.

Filed Under: About FactRight

Press Start to Replay: A Look Back at This Year’s Annual Due Diligence Conference

Filed Under: About FactRight

Shamrocks & Due Diligence: A Recap of FactRight’s 2025 RIA Due Diligence Conference

Filed Under: About FactRight

Action Packed Recap from FactRight’s 2024 Annual Due Diligence Conference

*Dramatic suspenseful music*

Thank you to the 480 industry professionals and wealth managers who ventured to the home of the Batman Building, Nashville, Tennessee for FactRight’s 2024 Annual Due Diligence conference. It was a legendary success, and we, the FactRight staff, are so grateful for your[...]

Filed Under: About FactRight

As the DST market has grown over the past several years, the nuances of available programs have proliferated. Given the structural requirements of Revenue Ruling 2004-86, these programs do not behave like traditional real estate investments in certain respects. In our experience working with wealth[...]

Filed Under: 1031 Exchange, DSTs

Highlight Reel from FactRight’s 2024 RIA Spring Due Diligence Conference

With March Madness upon us, what better way to celebrate then to recap some of the shining moments that happened at the FactRight RIA Spring Due Diligence Conference—and what a conference it was!

Filed Under: About FactRight

Loan Guarantee Fees in Investment Programs: Risk Compensation or Rent Seeking?

Company owners and other executives often receive compensation for providing a personal guarantee to a commercial loan their investment program is seeking. The size of this personal guarantee fee varies considerably, as does the level of disclosure. We believe the personal guarantor should be[...]

Filed Under: Regulation A+, Regulation D, Best Practices, Private Placements

FactRight Takes Salt Lake City

Filed Under: Due Diligence, Alternative Investments, About FactRight

Navigating the Cap Rate Landscape: How Real Estate Cap Rates Relate to Real Interest Rates

With limited success for centuries, astronomers charted the stars with hopes of better understanding the universe until one day when Copernicus suggested that the earth was orbiting the sun. Once his epiphany was fully understood, empires could navigate the globe with unprecedented precision by[...]

Filed Under: Due Diligence, Real Estate, Alternative Investments

.png)

-1.webp)

.webp)