Many real estate investment trusts (REITs) voluntarily report supplemental performance metrics. Industry organizations established non-GAAP metrics to build credibility and broader capital markets acceptance of REITs by enhancing comparability of operating performance across funds. Two decades ago, Nareit established Funds from Operations (FFO) for publicly traded REITs, and a decade ago, the Institute for Portfolio Alternatives (IPA) established Modified Funds from Operations (MFFO) guidelines for non-listed (NL) REITs. In addition, many traded and NL REITs report Adjusted Funds from Operations (AFFO) or other variations such as Core FFO and Funds Available for Distribution.

With all these different metrics, inconsistent reporting has been problematic for assessing and comparing NL REITs’ operating performance. Some report FFO only, some report FFO and MFFO, some report FFO and AFFO, and some do not report any of these measures at all.

So, what should analysts use? The answer depends on the analyst’s goal and available information. This requires understanding what each metric is and why it was created.

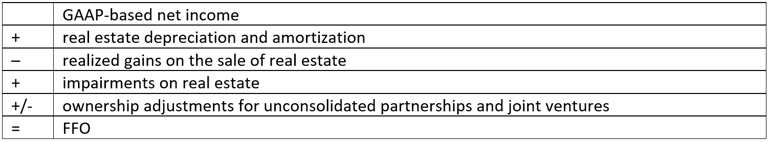

Funds from Operations (FFO)

FFO is highly standardized and is the most broadly reported supplemental operational performance metric for REITs. Nareit’s goal was to create a valuation multiplier for publicly traded real estate companies that would be more comparable to the price-to-earnings ratio for non-real estate companies. Price-to-FFO is used for comparing valuations across REITs. FFO was designed to adjust GAAP-based net income to better align with the forward-looking operational performance for real estate funds.

The most significant adjustment is the add-back of real estate depreciation and amortization. Historical cost accounting assumes the value of assets decrease predictably over time. However, real estate often appreciates, and values change with market conditions. Gains from sales and impairments are excluded from FFO because they are one-time events that don’t reflect the REIT’s future income generated from operations.

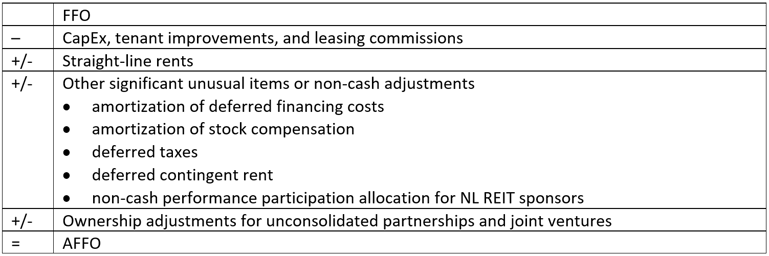

Adjusted Funds from Operations (AFFO)

AFFO is a non-standardized metric. Nareit has consistently stated that FFO is not designed for assessing dividend capacity or assessing operational cash flow used in discounted cash flow analysis. As a result, industry participants (i.e., REITs and REIT analysts) have been adjusting FFO to normalize operational cash flow ever since FFO was introduced. However, there is no consensus on the AFFO adjustments.

The most common adjustments are: (1) reductions for ongoing CapEx, tenant improvements, and leasing commissions needed to maintain the value and income stream of the real estate assets, and (2) straight-line rents to align rental income with the current rent due under the lease. Straight-line rents are usually a negative adjustment during the acquisition stage because net income is overstated when the average rent includes escalations over the lease term. These adjustments also help make it easier to compare across sectors.

AFFO has become increasingly popular among NL REITs over the past decade, particularly among institutional sponsors. Many NL REIT sponsors have been adding back non-cash performance participation allocations, which can have a significant impact on AFFO and dividend coverage.

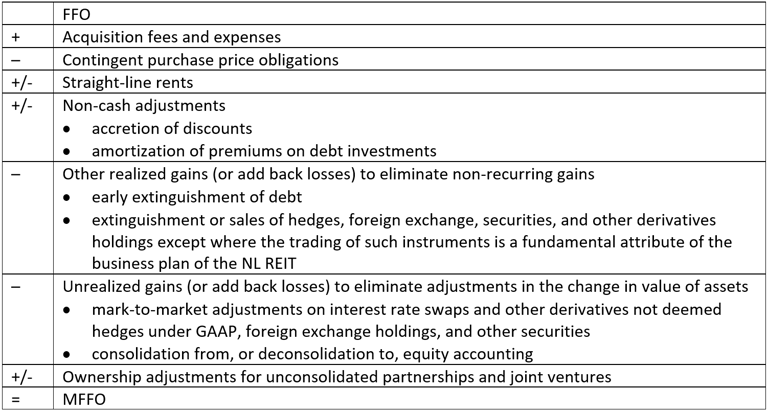

Modified Funds from Operations (MFFO)

MFFO is a guideline created to address challenges associated with evaluating the portfolio construction phase in the NL REIT lifecycle as well as early-stage performance of perpetual life NAV REITs. NL REITs typically start as a blind pool offering with a distribution rate based on management’s expectation of what the portfolio’s future investments will be able to produce. Application of the guidelines vary based on company structure, nature and stage of assets held, investment objectives, and investment phase. MFFO adjusts FFO by removing non-recurring operating results and making other non-cash adjustments.

Like AFFO, MFFO includes an adjustment for straight-line rents.

Unlike AFFO, MFFO adds back acquisition fees to affiliates and third-party expenses, which are one-time costs associated with a specific acquisition. This adjustment is more controversial because it can significantly improve the MFFO dividend coverage ratio during periods of heavy capital deployment. Once an NL REIT has built a stabilized portfolio, the adjustment should have a much smaller impact on a go-forward basis.

What to use to assess dividend capacity?

Analysts have several options based on their goals.

- Quick and consistent: Analysts who prioritize speed should use FFO as a supplemental measure because it is consistent and widely reported. Even though it’s not designed to assess dividend capacity, it’s better than net income because it adds back real estate depreciation and amortization. Another option is to simply use cash flow from operations to calculate dividend coverage.

- Same company analysis: Analysts reviewing a single REIT should use whatever metric the REIT reports since it reflects what adjustments management believes is important. Just make sure the metric consistently applies adjustments over time instead of cherry-picking to make the current period look more attractive. Also, be aware it might not be comparable with other REITs.

- More meaningful comparison: Analysts who prioritize the quality of information should consistently adjust FFO based on the most relevant and significant adjustments. This enables better comparability but requires more judgment and effort to compile and analyze.

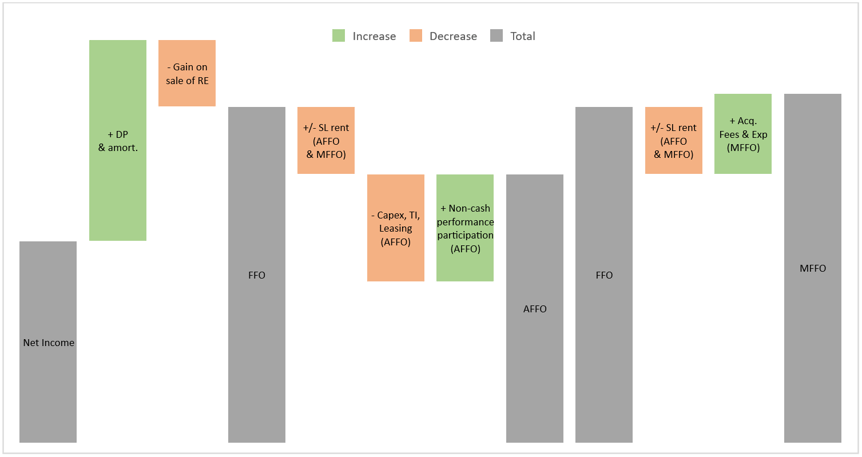

For illustrative purposes, the chart below shows how common adjustments can directionally impact FFO-related performance metrics.

Ultimately, Nareit summarizes it best. “The dividend-paying capacity of a REIT is best explained by a range of factors, including the economic characteristics of its assets, the degree of risk in matters of capital structure decided upon by individual companies, and other financial policy matters that are properly the province of management.” Therefore, analysis of a broad range of non-GAAP metrics, including FFO, MFFO, AFFO, and cash flow from operations, can form a constellation of factors to effectively understand a REIT’s current and prospective distribution capabilities.

Please feel free to reach out to FactRight’s Team of Analysts for more information on how to use performance metrics, including FFO, AFFO, and MFFO.

Contact Information:

Manager