An interval fund is a subcategory of closed-end funds and is a Regulated Investment Company (RIC), which is subject to 1940 Act regulation. Shares of interval funds are not generally “redeemable,” which is why the funds are classified as closed-end rather than open-end funds. Interval funds are so named because they must offer to repurchase shares at pre-determined “periodic intervals.” Although interval funds are closed-end funds from a legal standpoint, they also have features that are usually related to open-end funds, which is why they are sometimes described as a hybrid.

There were 78 active interval funds with over $54 billion in net assets as of the fourth quarter of 2021, compared to 66 active funds and $36 billion in net assets as of Q4 2020.

The following are three of the largest interval funds:

ACAP Strategic Fund (NASDAQ: XCAPX, XCWPX)

ACAP Strategic Fund (ACAP) is the largest interval fund currently with $11.7 billion in net assets as of December 31, 2021. ACAP invests primarily in publicly-traded equity securities of U.S. and foreign companies. ACAP raised $3.5 billion in capital during the fiscal year ending September 31, 2021 and $2.8 billion in the previous year. ACAP has a 7.68% exposure to China as a percentage of net assets. Investments are diversified by industry with e-commerce (9.37% of net assets) and enterprise software (9.33% of net assets) being the two largest allocations. Largest holdings in ACAP include JD.com Inc, Bilibili Inc, Alibaba Group Holding Ltd, and NetEase, Inc. The current yield on ACAP is 2.26% as the investment objective of the Fund is to achieve maximum capital appreciation.

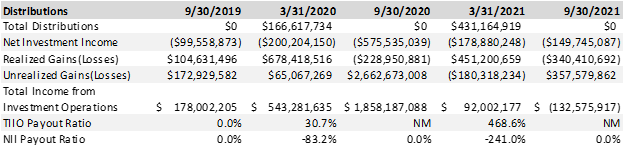

Distribution payout ratios over the past five reporting periods are detailed in the table below.

Griffin Institutional Access Real Estate Fund (NASDAQ: GIREX, GCREX, GRIFX, GMREX, GLREX)

Griffin Institutional Access Real Estate Fund (GIAREF) invests across private institutional real estate investment funds and public real estate securities. GIAREF is the second largest interval fund currently with $5.1 billion in net assets as of December 31, 2021. GIAREF raised $705 million for the fiscal year ending September 30, 2021 and $962 million during the previous year. As of October 1, 2021, investments in private and public real estate represented roughly 72.6% and 26.1%, respectively, of the total portfolio, with the remaining 1.3% being cash and short-term investments. The largest holdings in GIAREF include Cortland Growth and Income Fund, Clarion Lion Properties Fund, Morgan Stanley Prime Property Fund and Clarion Gables Multifamily Trust.

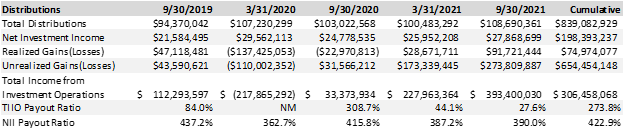

The current annualized distribution rate is 5.22% as of September 30, 2021. Distribution payout ratios over the past five reporting periods are detailed in the table below.

See the Factright Report Center for ongoing coverage of the Griffin Institutional Access Real Estate Fund.

Cliffwater Corporate Lending Fund (NASDAQ: CCLFX)

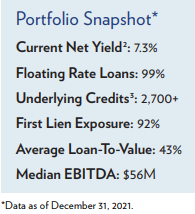

Cliffwater Corporate Lending Fund (CCLF) invests in loans to U.S. middle market companies originated and managed by non-bank lenders selected by Cliffwater LLC. CCLF ranks number three among active interval funds with $4.7 billion in net assets as of December 31, 2021. CCLF raised $4.0 billion in proceeds from shares sold for the year ending December 31, 2021, and $91 million from shares sold in 2020. The portfolio is relatively diversified: information technology-21%, healthcare-16%, industrials-15%, business services-12%, consumer discretionary-11%, and all other industries make up the remaining 23%. From inception through February 28, 2022, CCLF has provided 8.57% return to investors while the S&P LSTA Leveraged Loan Index has returned 4.12% over the same period.

Cliffwater Corporate Lending Fund (CCLF) invests in loans to U.S. middle market companies originated and managed by non-bank lenders selected by Cliffwater LLC. CCLF ranks number three among active interval funds with $4.7 billion in net assets as of December 31, 2021. CCLF raised $4.0 billion in proceeds from shares sold for the year ending December 31, 2021, and $91 million from shares sold in 2020. The portfolio is relatively diversified: information technology-21%, healthcare-16%, industrials-15%, business services-12%, consumer discretionary-11%, and all other industries make up the remaining 23%. From inception through February 28, 2022, CCLF has provided 8.57% return to investors while the S&P LSTA Leveraged Loan Index has returned 4.12% over the same period.

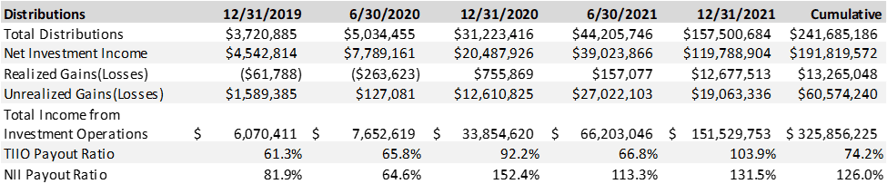

Distribution payout ratios over the past five reporting periods are detailed in the table below.

Contact Information:

Analyst

(612) 326-1116