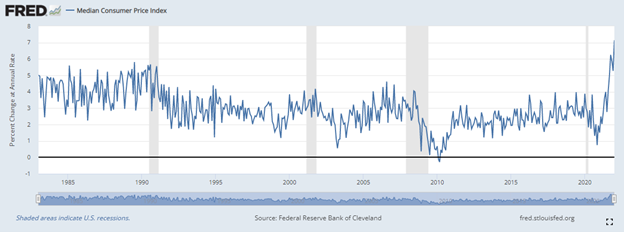

Inflationary pressures have increased markedly in the global economy over the last year. CPI prints have recently reached levels not visited in almost four decades.

This has stoked discussion of increased interest rates from historically low rates in order to stem the tide of rising inflation. The Federal Reserve recently noted that given persistently high inflation, multiple interest rate hikes are possible in 2022 if inflation does not slow to pre-pandemic levels. Higher interest rates and the attendant increase in the cost of capital to businesses to finance their operations may lead one to inquire as to whether default rates will increase if the cost of debt financing is to marginally increase in the coming quarters or years. A majority of high yield oriented alternative asset investment vehicles target floating rate leveraged loans and CLO securities, which may blunt some of the effects of rising interest rates as increasing LIBOR (or increasingly SOFR as reference index) upwardly adjusts the interest obligations of borrowers. If interest rates were to increase, it may materially weigh on returns of credit focused alternative investment vehicles as default risks may increase with increasing borrowing costs. What this blog post will explore is how high yield credits have fared in previous inflationary environments.

Current Default Dynamics

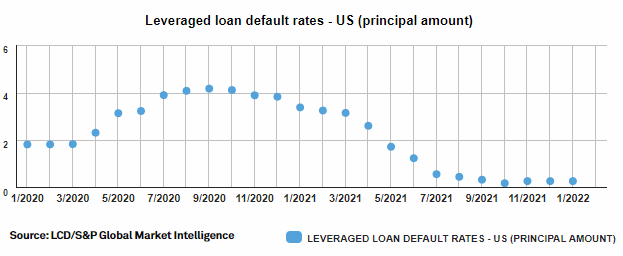

First, let’s take a quick look at the leveraged loan and high yield marketplace default dynamics today and place it into broader historical context. As the following charts highlight, default rates on broadly syndicated leveraged loans have moderated significantly from a brief spike in the second and third quarters of 2020 following the dislocation related to the COVID-19 pandemic.

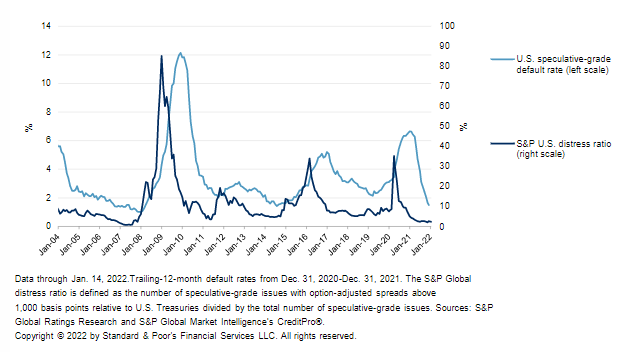

Looking back to the mid-2000s, we can place this COVID-19 spike in broader context of the great financial crisis of 2007-9 and the energy related distress of the mid-2010s. The duration of the COVID-19 distress was comparatively short to these previous periods of distress in the high yield markets. Unprecedented monetary and fiscal support, including direct purchasing of corporate credit and PPP loans to many small businesses, invariably supported the quick snapback and muted the default environment. It is important to recall that during the early stages of the pandemic, certain ratings agencies were predicting default rates in the high yield market to rise into the low double-digit percentage range.

Likewise, the distress ratio, which tracks speculative grade loans currently trading at 1,000 basis points above similar duration treasuries, has moderated back to more benign levels of approximately 2.4%, as noted by the dark blue line in the chart below.

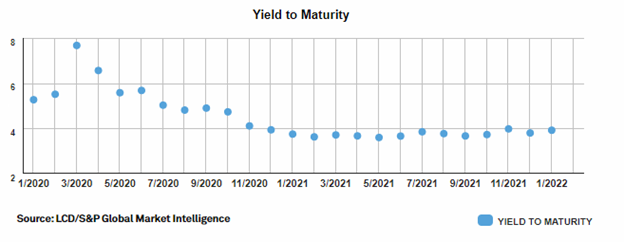

Finally, yields in the leveraged loan market show a moderation since the spike related to the COVID-19 pandemic as volatility in loan pricing based on uncertainties early in the pandemic fizzled out in a sea of liquidity from accommodative monetary and fiscal policies, and as economies slowly opened back up.

All these signs point to a benign default environment for leveraged loans and the high yield bond market. However, the question remains: what does a rising inflationary environment portend for default rates on speculative credits?

Inflationary Periods and Defaults

For this, we have consulted some academic inquiries into the subject, namely the white paper Inflation and Default Dynamics[1]. This research analyzed the period from 1970 through 2010, which included bouts of persistently high inflation including 1973-1981 when CPI inflation averaged 9.3% per year, with a high of 13.5% in 1980.

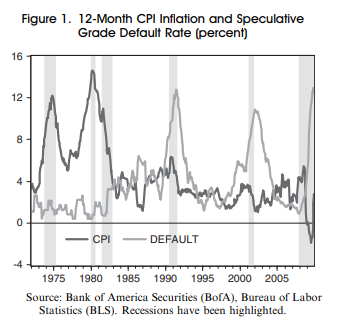

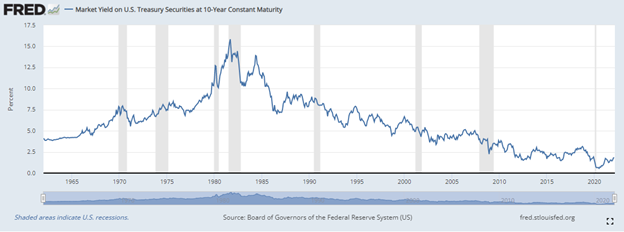

The following chart contrasts the speculative grade default rate (light gray) with the 12-month CPI mark. As one can see, the default environment was muted throughout the 1970s, averaging 1.3% and within a 0.4% to 1.9% range. Default activity increased substantially in the 1980s following an increase in interest rates as Paul Volcker sought to crush rampant inflation. This is highlighted by the peak in interest rates noted in the early 1980s in the second chart below.

[1] Inflation and Jain, Parul, and Leo Kamp. “Inflation and Default Dynamics.” Business Economics, vol. 45, no. 3, 2010, pp. 174–86. JSTOR, www.jstor.org/stable/23490991

Generally, default activity decreases, or is benign, in periods of increasing inflation and increases in deflationary environments. This makes intuitive sense as increasing inflationary periods lead to higher prices and asset values, which can increase businesses operating cash flows and lead to comparatively reduced nominal interest expenses on fixed rate debts, whereas deflationary periods may lead to reduced cash flows and lower or stagnating asset prices, which in turn weighs on nominal interest expenses. However, it is important to note that a catalyst for the deflationary period may be changing monetary policy through rising interest rates, which as the chart above notes have generally declined over the past 40 years. A period of increasing debt financing costs for American businesses has not been experienced in a generation and may lead to increasing default pressures.

Tying this data back to credit oriented alternative investment vehicles, what if the loans are floating rate, which was not as prominent of a financing structure during the time period of the historical data, but in contemporary times has increased in importance with the prevalence of leveraged loan and CLO security portfolios in ‘40 Act Funds like BDCs and interval funds? The data is largely silent on this specific credit structure factor. Additionally, the monetary policy responses to combat inflation (namely increasing interest rates) complicate matters within the default analysis for purposes of isolating the inflationary effects on default. Overall, the data suggest that increasing inflationary environments themselves are likely to result in low levels of defaults but decreasing inflationary environments, perhaps following aggressive policy responses, including increasing interest rates, are likely to result in increased default activity. How well borrowers are able to pass through increasing interest expenses to their creditors given the prominence of floating rate credit structures remains to be seen, and historical evidence suggests that in a decreasing inflationary environment, following a period of heightened inflation, that may be a challenging prospect. Given recent headlines and statements from the Federal Reserve we may be encountering such changing dynamics in the near to medium term, however, in light of heightened geopolitical risks with the invasion of the Ukraine it is possible policy timing or recalibration may be in order. As these inflation and interest rate dynamics change effects will be felt in speculative credit markets, this further highlights the need for wealth managers to conduct ongoing due diligence of the programs on their alternative investment platform.

Contact Information:

Co-President