I’m going to get this out of the way right now. I don’t know where cap rates will end this year, and certainly can’t predict where they will be in five years or in ten. What I do know is that cap rate compression has provided a notable tailwind to real estate performance for the past several years. With cap rates for most real estate sectors touching record lows during fourth quarter 2021, I also know that investors should be more closely analyzing each driver of projected investment returns and determining the margin for error embedded in each one. It seems unlikely that cap rates will be below current levels in five or ten years when investment programs currently on offer are looking for an exit.

I think we have reached a point where Investors should anticipate little if any positive contribution to investment returns from the purchase-disposition cap rate spread. For this blog post, I am considering the primary drivers of investor returns to be NOI improvement and the spread between purchase and disposition cap rate. The relative importance of each varies by sector, security type, time horizon, among others. That said, an investment where each of these drivers is contributing favorably is generally less risky than an investment supported by just one. Variances from projections, particularly negative variances, are more readily absorbed with support from all drivers.

Let’s step back for a moment. Cap rates are, at the same time, simple and extraordinarily complex. On one level, the cap rate is simply the ratio of net operating income (NOI) to the purchase price. With this information, a purchaser can get a sense of the current unlevered return and how the price paid compares against history or other similar properties. At a more complex level, the cap rate can be disaggregated into multiple components. Anyone remember DuPont analysis? In this case, the cap rate can be divided into the risk-free rate plus a growth forecast and a risk premium.

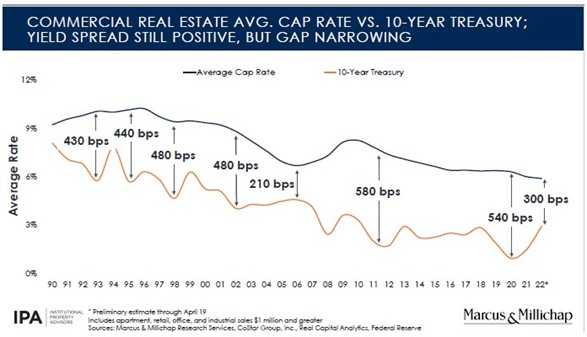

There is considerable commentary available online about assessing the implied risk premium. The most common methods to measure the premium use the spread between cap rates and the 10-year treasury, or cap rates and BBB-rated bond yields. Incidentally, spreads have narrowed over the past year as treasuries and BBB bond yields have risen while cap rates have moved little and remain near historic lows. This is visible in the chart below from Marcus & Millichap, which includes estimated rates through April.

There have been a number of studies that demonstrate that cap rates have a weak correlation to interest rates. Rightly so. Cap rates are influenced by a number of market-specific factors including supply/demand for properties in the various submarkets and availability of real estate financing. Still, cap rates will tend to trend with interest rates, particularly over longer periods of time due to overall expectations for economic growth and inflation. This is important to note, since the typical private real estate investment has a time horizon between five and ten years, as noted at the outset of this post.

Turning to the due diligence process, Investors need to first review a sponsor’s cap rate assumptions. For the past few years, many sponsors from across the real estate spectrum have been building disposition cap rates that are lower than the purchase rate into their return models, consistent with the ongoing compression in markets around them at the time. Given the more uncertain interest rate environment and narrowed risk spreads, FactRight has started to see some sponsors adjust cap rate expectations. A few sponsors began in late 2021 to incorporate exit cap rates that were unchanged from the purchase rate. More recently, I’ve started to see modestly higher cap rate assumptions, particularly in multifamily and SFR. Still, there are programs currently being marketed that need compression to work, and do not include significant enhancements, like renovations or added amenities.

In the absence of a cap rate-driven boost to disposition price, the return contribution from NOI growth figures more prominently. A higher NOI at the time of sale contributes to a higher disposition price. As such, the next aspects of a sponsor’s projections that investors should be looking carefully at are revenue and cost projections and the impact on margins.

On the revenue side, one should look at the pace of increase in lease/rent rates and expectations for occupancy. Are the forecasts consistent with local market forecasts? How frequently is the lease repriced? What I’ve seen recently has been heavily front-end loaded rent increases and a general return to long-term trend growth by year four. Considering recent trends and ongoing supply constraints, this appears reasonable. Nearly all property marketing brochures I’ve looked at recently are quick to note the rent potential due to a large percentage of below-market rents.

I feel additional attention should be placed on the cost side of owning and managing properties. There seems to be greater risk for surprises from expense categories like wages and salaries, energy costs, and property taxes. Most of the models I’ve seen lately incorporate an initial margin expansion from operational and managerial efficiencies followed by annual increases at historical trend rates. As an aside, I would like to see more property management contracts where the manager’s fee is calculated as a percentage of NOI rather than gross income.

In keeping with the title of this blog post, I need to acknowledge the impact that lower financing costs have had on the acquisition price for real estate. If everything else is unchanged, a reduction in ongoing interest expenses allows a purchaser to pay a higher going-in price and still generate the same desired return. This, in turn, can, and has, contributed to lower cap rates. While sponsors still have ways to soften the impact of a rise in interest rates, like a greater loan-to-value or interest rate paydowns, lenders are likely to adjust loan terms and covenants to protect their interests. In my view, the direction of interest rates, particularly recent moves, also represents a potential headwind to cap rates, and one’s due diligence process must reflect this possibility.

There are a bewildering number of articles and white papers available online from highly credentialed, seasoned industry professionals, with equal numbers convincingly arguing that cap rates are going higher or lower in the next year. With this blog post, I wanted to step away from that discussion and remind investors making investment decisions today, which may not have an exit for at least five years, that cap rates fluctuate, and may fluctuate a lot between now and then. However, it is essential to understand how much margin for error the program sponsor has built into their projections and how that compares to similar programs with differentiated target returns.

Contact Information:

Manager

(612) 284-3119