Background

ESG has been around for a very long time. In its most basic form, impact investing was first used in the 1800s when the Methodist church urged members to avoid sin stocks (e.g., gambling, alcohol, tobacco, and weapons).

Before the early 2000s, advisors were unsure if ESG conflicted with their fiduciary duty because portfolio decisions based on non-financial factors could reduce returns and diversification. ESG investing started gaining traction after the United Nations Environment Programme (UNEP) issued fiduciary duty guidance. Its initial 2005 report concluded that “ESG integration is clearly permissible and arguably required.” UNEP’s 2016 final report on fiduciary duty discusses several studies that show a positive correlation between the performance of material ESG factors and stock performance.

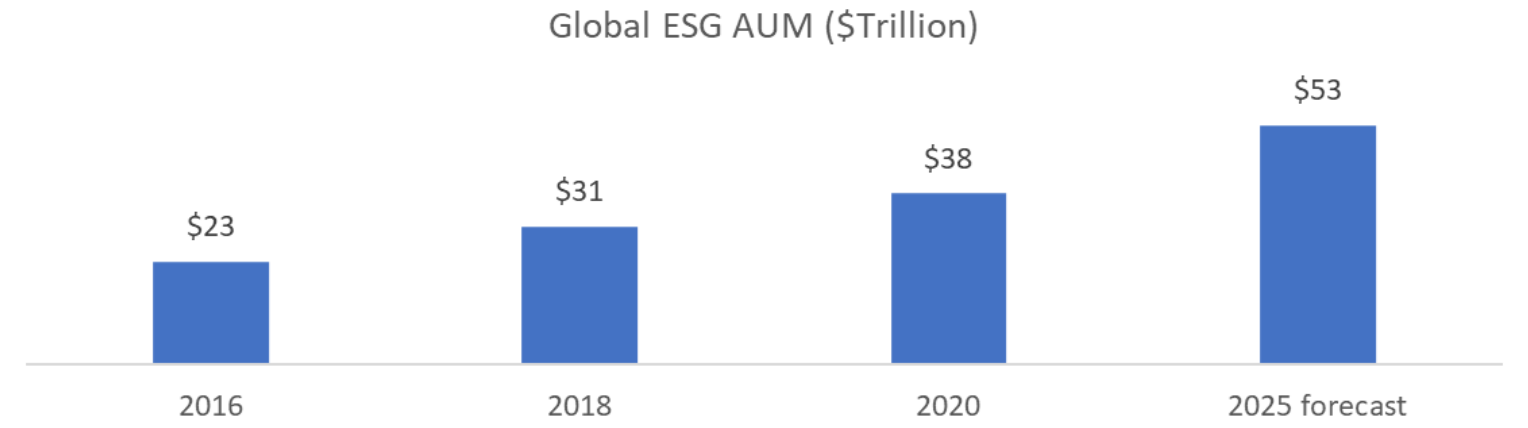

ESG investment awareness and demand are growing by both institutional and retail investors. In alignment with local laws, institutional investors with long time horizons consider ESG factors as part of their fiduciary duty in generating long-term portfolio performance. Bloomberg forecasts that ESG global AUM may reach 1/3 of total global AUM. Europe represents half the ESG AUM, but the US may exceed Europe this year.

Source: GSAI, Bloomberg Intelligence

What is ESG?

But what is ESG? As ESG becomes more mainstream in the United States, retail investors are becoming increasingly aware of this acronym. ESG is often misunderstood as a negative screening rule, an opaque ratings calculation, and/or a marketing tool with no standardized language.

Instead, CFA Institute defines ESG investing as “an approach to managing assets where investors explicitly acknowledge the relevance of environmental, social, and governance (ESG) factors in their investment decisions, as well as their own role as owners and creditors, with the long-term return of an investment portfolio in mind. It aims to correctly price social, environmental, and economic risks and opportunities.”

The goal of ESG is to correctly price material risk factors and opportunities, explicitly focusing on three components.

- Environmental factors such as extreme weather and natural disasters have become more important to investors. Key issues include climate change, pressures on natural resources, biodiversity, pollution, waste, and energy use. These factors lead to physical and transitional risks to companies.

- Social trends that materially impact business activities include items such as labor rights, inequality, wealth gaps, diversity, inclusion, automation, artificial intelligence, urbanization, changing demographics, occupational health and safety, human capital development, etc.

- Governance is how companies are managed and controlled. It covers topics such as formal governance structures, internal policies, share class structures, shareholder rights, leadership, executive pay, audit practices, board of directors’ independence and expertise, transparency and accountability, related-party transactions, political contributions, bribery and corruption, and whistleblower protections.

Six Methods to Applying ESG

There are six main ways investment managers can apply ESG factors, which may result in different portfolio compositions.

- Negative or exclusionary screening avoids companies that conflict with the investor’s values (e.g., smoking, gambling) or international norms (e.g., child labor). This is the oldest and most common method because it is the simplest to understand and easiest to implement.

- Positive or best-in-class screening selects companies with better or improving ESG performance than its peers. The goal is to improve portfolios’ risks and returns.

- Active ownership, stewardship, or engagement is about engaging with companies to drive change. It’s considered one of the best ways to maximize risk and returns, but it requires the most effort.

- Thematic investing invests in a specific trend, which often focuses on sustainability.

- Impact investing seeks to generate measurable social and environmental benefits along with financial returns. These investors may have a more charitable mission than traditional investors.

- ESG integration systematically integrates explicit ESG factors into investment and financial analysis to mitigate risks and find opportunities. It involves both qualitative and quantitative approaches and has fewer constraints compared to the other methods. Since this approach is more subjective, managers should maintain strong documentation to support their analysis to investors.

International Research and Standards Organizations

The ESG landscape is significant. Many international organizations provide frameworks and standards designed to complement each other. Additionally, there are companies that provide data aggregation services and companies that offer assessment/scoring services based on their own proprietary methods.

As more managers incorporate ESG factors, they have been providing information to help investors better understand their investment strategy. Currently, ESG reporting disclosures are voluntary in the US. It may be presented as a stand-alone report and does not need to be part of annual 10-K filings. While there are no required standards, there are several organizations providing frameworks and guidelines. These are just a few of the leading independent organizations:

- Global Reporting Initiative (GRI). GRI is an independent, international organization formed in 1997 after the Exxon Valdez oil spill. It provides a common language to communicate impacts. GRI issued its first version of its guidelines in 2000 and has made several updates over the years. In 2011, it issued its first sector-specific standard for oil and gas

- UN Principles for Responsible Investing (PRI). PRI was formed in 2006 and is the most influential organization for advancing ESG. The PRI is an independent organization that seeks to understand the investment implication of ESG factors in long-term value creation. It provides guides, research, and other ESG-related resources.

- Sustainability Accounting Standards Board (SASB). SASB was formed in 2011 to develop a common language and provide disclosure guidelines for companies to communicate ESG information to investors. SASB is a nonprofit standard-setting organization that created 77 industry-specific disclosure standards across 11 sectors which are used by companies and investors around the world. Its goal is to provide relevant and material disclosures by narrowing it down to an average of 6 topics and 13 metrics per industry. Disclosure guidelines are informed by market participants to drive usefulness, standardization, and cost-effectiveness. The guides are tools to provide useful information, and companies’ boards ultimately decide what is relevant to report.

Regulatory Approaches

As guidelines mature and ESG AUM has grown, it has been getting more attention from US regulators.

FINRA and the SEC have taken different approaches on different ESG factors. For example, FINRA solicited feedback to very specific questions around social factors for its own application, and the SEC proposed disclosure around environmental factors for communication with investors.

FINRA Diversity, Equity, and Inclusion (DEI)

Last year in 2021, FINRA issued Regulatory Notice 21-17, in which FINRA Seeks Comment on Supporting Diversity and Inclusion in the Broker-Dealer Industry. FINRA received several well-thought-out suggestions related to reducing barriers to entry around the exam, registration, inspection, and qualification maintenance processes. Many comments specifically supported the amendment to Rule 1210. In November 2021, FINRA issued Regulatory Notice 21-41 to Enhance the Continuing Education Program for Securities Industry Professionals.

Eileen Murry, FINRA’s chairperson since 2016, gave an interview in November 2021 and said we need ESG regulation to drive real transformation. She said that her stance took a 180-degree change over the past two decades. Early in her career, she was against regulation of DEI because she thought companies would do the right thing. Over that time, representation of women in senior positions increased from approximately 0.5% to 17%, and she believes that’s not far enough along. She realized that even companies with good people prioritize the urgent instead of investing time into the important (e.g., pay equity should be table stakes). To drive real transformation, we need accountability, consistency, and transparency, and the solutions must come from collaboration within the ecosystem of regulators, businesses, and educators. Ultimately, disclosure requirements lead to greater accountability.

SEC Environmental Risk Disclosure Proposal

On March 21, 2022, the SEC published proposed rules to Enhance and Standardize Climate-related Disclosures for Investors, and the comment period ended in June. The SEC wants companies to provide investors with consistent and standardized disclosures in registration statements and periodic reports such as the 10-K. Disclosure focuses on the likely material impacts of climate-related risks to a business, strategy, outlook, governance policies around climate-related risks, climate-related financial metrics, and any target climate-related goals. The proposed scope and compliance timeframe compliance would have a phase-in period depending on the company’s size. Beginning in 2024 for fiscal year 2023, accelerated filers would be required to make disclosures with attestation of certain metrics by an independent auditing firm. Small companies would be required to make disclosures beginning in 2026 for fiscal year 2025 and would not be subject to attestation requirements.

On May 25, 2022, the SEC issued a proposed rule for Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices. The comment period closed in July. This would require certain RIAs and BDCs that pursue ESG strategies to provide more specific disclosures in their prospectuses, annual reports, and brochures. For example, if a fund is targeting a specific impact, it would need to disclose the impact and progress in achieving that impact. Funds that focus on engagement strategies would need to disclose information on their proxy votes.

Going Forward

As ESG continues to mature, I expect we will see market participants will drive more sector standardization disclosures for material ESG factors. Some disclosures may shift from voluntary to required, and there may be a shift from disclose or explain to disclose and explain. Standardization of meaningful information should provide more clarity to companies on what to report to help investors make better investment decisions. Overall, it should provide a better outcome for long-term value creation.

Contact Information:

Manager

(612) 284-4034