New unemployment claims continued at a staggering rate, with 4.4 million claims reported on April 23, 2020. This marks a decline from previous weeks but brings total claims to over 26 million since the beginning of the COVID-19 outbreak. When added to the 7 million claims prior to the outbreak the result is a 20% unemployment rate, the highest level since 1934.

Cantor Fitzgerald has reported job cuts of hundreds of positions, including in its commercial real estate division. The company noted more job losses may occur in the coming weeks as well. James Gorman CEO of Morgan Stanley, who personally fell ill with COVID-19 (and subsequently recovered), in contrast has stated it was a “no-brainer” to not layoff employees during the continuing COVID-19 outbreak. Other wall street firms have followed suit in pledging not to incur job losses during the pandemic. Mr. Gorman also commented how work-from-home measures may likely be a lasting feature of their operational structure, a topic undoubtedly broached in many offices around the world. All signs are pointing to structurally weaker demand for office real estate in the future.

Mortgages in Deferral

Mortgage and real estate data provider Black Knight Inc. reports that 2.9 million mortgages are presently in forbearance, accounting for 5.5% of all mortgages in the US. This includes 7.6% of all FHA/VA loans and 4.9% of all GSE-backed loans. Average principal balance on those loans in forbearance is approximately $224,000. Given the continued increases in jobless claims one would imagine this mortgage forbearance trend may continue to increase.

Precursor to a debt jubilee? A bill is floating through the House of Representatives to do away with rent payments and mortgages for the remainder of the pandemic.

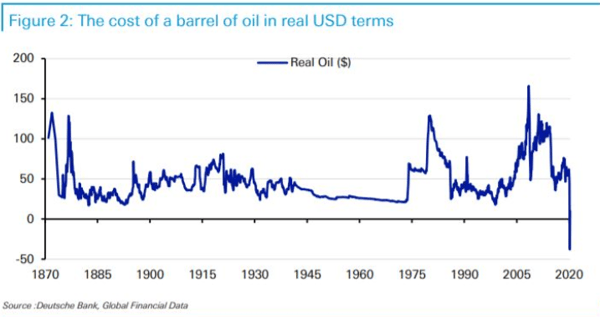

Sub-Zero Oil

Oil prices dropped to historically unprecedented (those words have popped up a few times in the past month) lows in the past week. Oversupply, inadequate production cuts from major producers, demand destruction related to shelter-in-place orders, and concerns about a lack of storage lead to oil prices plunging below zero. The following chart, courtesy of Deutsche Bank, highlights the inflation-adjusted cost of a barrel of oil going almost all the way back to Titusville in 1859. That’s right, oil prices lower than at any time since perhaps the Lincoln Administration were spotted in markets this past week. Needless to say, the outlook is bleak for many participants in the industry and their creditors.

ETF Troubles

Some of the issues in the oil price decline are attributed to a popular investment vehicle of day-traders, the United States Oil Fund, LP (NYSE: USO), an exchange-traded fund. USO seeks to track the WTI crude oil price by constructing a portfolio of 1-and 2-month rolling futures. Some reports indicate USO controls over 30% of the June futures in the market. USO began expanding out to include futures beyond 1-and 2-months, suspended share creation mechanisms (via creation baskets with authorized purchasers (click here for a primer on ETF share creation), and announced it would execute a 1-for-8 reverse split on April 28, 2020. All in a weeks’ work for USO. The suspension in share creation means the arbitrage mechanism that works to ensure the ETF trades in line with its underlying NAV is out of balance. USO now trades like a closed-end fund, at a premium or discount to its underlying NAV.

PCAOB Sanctions Whitley Penn LLP

The Public Company Accounting Oversight Board (PCAOB) has imposed sanctions on Whitley Penn LLP (WP) and certain of its partners related to WP’s audits of United Development Funding III, L.P. (UDF III) and United Development Funding IV (UDF IV, formerly listed on NASDAQ: UDF) from 2012 to 2015. The PCAOB noted that three WP partners failed to exercise due professional care, including professional skepticism, in connection with procedures used to determine whether certain UDF III and UDF IV loans were properly valued. Additionally, the PCAOB noted that certain partners did not appropriately respond to evidence of possible undisclosed related party transactions between UDF III and UDF IV. Additionally, the PCAOB noted that WP failed to maintain adequate quality control standards.

The PCAOB imposed civil money penalties of $200,000 to WP, and a cumulative $50,000 in penalties to three partners at WP. Additionally, one partner was barred from being an associated person of a public accounting firm for a period of two years, another partner was suspended for one year and the third was restricted in the services they may provide related to audits for a period of two years.

UDF III and UDF IV have not filed financial statements since the third quarter of 2015. WP declined to stand for future audits of UDF III and UDF IV in November 2015.

China, Trade and Coronavirus Stimulus

Noted UDF IV short seller Kyle Bass has some interesting thoughts on China, trade policy and China’s Belt and Road infrastructure initiatives. Mr. Bass highlights an under reported development that Japan’s coronavirus stimulus package is looking to pay its domestic firms for costs (up to $2 billion in aggregate) related to repatriating supply chains located in China back to Japan. The United States has attached less tangible policy goals as part of its stimulus response to the COVID-19 outbreak.

Sizzling Resentment

We noted last week that Ruth’s Chris was the recipient of $20 million in government loans under the paycheck protection program (PPP). 220,000 people signed a petition urging them to return the money. Ruth’s Chris announced it would return the money. Over 150 publicly-traded firms received over $600 million in loans under the PPP, according to CNBC, you know, your typical main street Mom and Pop publicly-traded company. After running out of funds, the PPP was subsequently expanded with $310 billion in additional funding.

BDCs

The SEC has granted BDCs with temporary relief regarding asset coverage ratios. Detailed explanations on the mechanics of this relief can be found here and here. The practical effect of this regulatory relief is to allow BDCs the continued use of fair value marks on portfolio assets held as of December 31, 2019, provided that credit is not permanently impaired (i.e. has not had realized losses), in satisfying the BDCs current asset coverage ratios. This is designed to allow BDCs to continue to access capital and provide capital to their borrowers. Additionally, the exemptive relief allows for affiliates of the BDC (that has an effective co-investment order) that are not presently invested with an issuer to make investments in the issuer, essentially allowing advisor’ affiliates to help inject new capital into BDC portfolio companies. A BDC’s board of directors must approve the utilization of this relief and the BDC must file a current report on Form 8-K to avail themselves of this relief.

This BDC relief and the COVID-related provisions for lease modifications for publicly-reporting landlords (that we touched on last week) may set the stage for a larger fudge factor in ascertaining the underlying economics of certain real estate and credit investment programs’ portfolio credit quality and performance in their coming SEC filings.

Capitalism without Bankruptcy is like Catholicism without Hell

Well stated from the eloquent and prescient Howard Marks. Mr. Marks latest memo is stimulating and captures a certain rebellious spirit that questions why are we as a society allowing the bailout of leveraged investment vehicles as part of our response to the COVID-19 outbreak? Mr. Marks is not alone in that sentiment.

Publicly traded REIT Notes

First Capital REIT (not this First Capital) announced it collected approximately 70% of April rents, additionally noting that 45% of its tenants had been approved for an initial rent deferral of two months. First Capital REIT is a Canadian REIT that has a portfolio of mixed-use urban and shopping center properties. First Capital noted that if all rent deferral applications from tenants are approved it would comprise approximately 15.3% of gross monthly rent.

Secure Income REIT (LSE: SIR), a U.K. listed REIT, has filed a press release noting it is “disappointed and surprised” that it has not received a proposal from Travelodge Hotels Ltd. related to outstanding amounts due. This comes on the heels of SIR noting that they have been in discussion with Travelodge’s senior management team for a number of weeks on the issue. SIR notes that Travelodge, which is owned by Goldman Sachs Group Inc., Avenue Capital Group LLC and GoldenTree Asset Management LP, accounts for 6.4% of its annual rental income. SIR announced that it has “reluctantly initiated actions to recover” the rents owed to it. Travelodge has reportedly engaged investment banking firm Moelis and accounting firm Deloitte to negotiate rent breaks or deferrals with its landlords as it is concerned it may run out of cash before its hotels are allowed to re-open, according to the Financial Times. There’s a certain irony about hiring (presumptively expensive) mercenaries like Moelis to tell your landlord, hey, we’re struggling here. One would think that negotiating with counterparties about terms of deals would be, firmly within the purview of the executives of a real estate-oriented business, like a hotelier? SIR subsequently reported that it collected approximately 74% of rents due in the March quarter.

We continue to eagerly scour news sources and EDGAR for data related to rent collection trends across real estate sectors.

Sports Gambling (sadly still no sports)

We may not currently be able to watch or attend live sports events, but now you can buy stock in one of the most popular sports gambling websites around. DraftKings Inc. completed its reverse merger with blank-check company Diamond Eagle Acquisition Corp. (NASDAQ: DEAC). DraftKings stock will begin trading on NASDAQ April 24 under the ticker symbol “DKNG”. Some have voiced concern regarding the disproportionate voting rights of the founders. However, this is par for the course at tech companies such as Facebook or Google, or more historically, the Ford Motor Company. If you start a company and go public and you want to have special share classes to ensure you keep control of your baby? More power to you. If you don’t like it, don’t buy the shares.