It’s understandable that private real estate investors would be sensitive to the relationship between interest rates and commercial property. Cap rates for many asset types are near all-time lows, and the Fed is eyeing more rate hikes in the short term. We share the concerns of many in the alternative investment industry that some syndication structures are not ideal for weathering a rising cap rate environment, especially those featuring underlying assets subject to long-term, bond-like leases. We’ve previously explored the relation between interest rates and commercial property returns on this blog here and here.

However, although it is important to consider that interest rates and cap rates bear a positive correlation all other things being equal, rising interest rates are typically accompanied by economic growth and strengthening fundamentals, which, as one can surmise, have a bolstering effect on real estate returns.

Striking lack of correlation

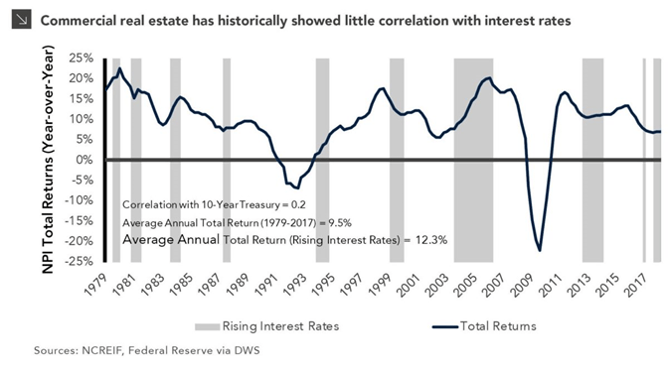

That interest rates don’t bear a lock-step relationship to cap rates is a contrary perspective that turns out not to be so contrary after all. Marquette Associates is the latest to publish the view that in periods of rising interest rates, real estate returns tend to be strong. During rising interest rates periods since 1979, the total annual return of the NCREIF Property Index (NPI)—which tracks privately-held apartment, hotel, office, and retail assets—has averaged 12.3%, as Marquette’s chart below illustrates:

(It’s interesting to note that, as shown in the chart above, generally the NPI decreased after periods of increasing interest rates). Other research firms like TH Real Estate simply fail to find a correlation between rising interest rates and property values. In fact, that firm charts a correlation of 0.08, suggesting that private real estate can actually be a hedge against rising rates:

With forecasts for stronger economic growth and rising inflation, real estate should remain attractive as a source of portfolio diversification, stable cash flows, higher risk-adjusted returns relative to other asset classes, and inflation hedging.

Cohen & Steers finds a similarly weak linkage between cap rates, and the federal funds rates and U.S. Treasury yields. It observes that the FTSE NAREIT Equity REIT index has actually outperformed stocks and bonds during rising interest rate environments. While charting a more positive correlation, TIAA Global Asset Management admits that “the impact of rising interest rates on real estate performance is difficult to predict.” Economic expectations, NOI growth rates, and spreads relative to U.S. corporate bonds appear to have more to do with real estate values than interest rates do.

Of course, programs with variable rate debt are subject to reduced cash flows when rates rise. Furthermore, regardless of interest rates, commercial real estate goes in cycles. It is difficult to predict where the cycle will be in several years, near the end of a particular investment program’s stated lifecycle, or when that DST’s long-term loan comes due. But in the meantime, economic growth should be a boon to real estate performance.