This morning the Internal Revenue Service and Treasury were scheduled to hold a public hearing regarding the proposed Treasury Regulations on investment in qualified opportunity zone funds. However, the IRS cancelled today’s public hearing because of the ongoing Federal government shutdown. While government bureaucracy and partisan politics have delayed the finalization of the Treasury Regulations (an unfortunately my visit to the Smithsonian museums in Washington DC), it has not furloughed FactRight’s effort to create a comprehensive due diligence program for reviewing the QOZ funds that are starting to become available through the broker dealer and RIA channels.

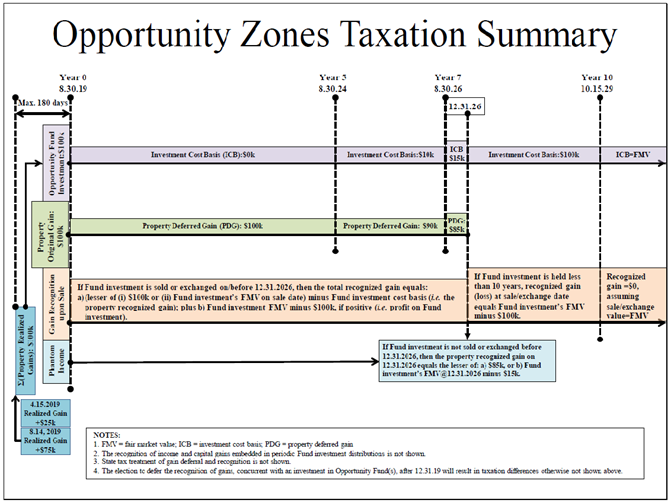

As part of our effort, FactRight has connected with numerous industry experts in the QOZ fund community over the last few months. One of those experts is Paul Saint-Pierre, the principal advisor of PSP Advisors, which among other things provides research and advisory services that specifically focus on QOZ investment opportunities. Mr. St. Pierre has created lots of helpful content around QOZ opportunities, particularly from an investor perspective. Taken from one of his recent whitepapers, the chart shown below simply and elegantly illustrates the tax benefits associated with QOZ investments over various hold periods, so we thought we’d share it with you as we all continue to ramp up due diligence efforts on QOZ fund investments.