On July 19, American Finance Trust, Inc. listed on the NASDAQ exchange (under the symbol “AFIN”). Since listing, the shares have traded in a range of approximately $13 to $17 per share., which represents a steep discount to both net asset value (NAV) per share and book value per share (approximately 33% to 45% discount to the $23.56 estimated NAV per share, and up to a 20% discount to book value per share of $16.35). Since listing, we have received many inquiries from our broker dealer and RIA clients on why the shares are trading at such a discount from the $25 per share IPO price. I think there are a couple of key points regarding the trading range’s relation to the initial public offering price (when the program was offered as a non-traded REIT) that are important to understand:

Overdistribution and upfront load

AFIN overdistributed from CFFO approximately $171.4 million, and from FFO approximately $151.2 million, respectively, from inception through the first quarter 2018. This is in addition to front end costs of approximately $143 million, which are approximately 10% of gross proceeds. Here, and in other non-traded REITs, overdistribution and front-end costs eroded shareholder value.

Publicly-traded single-tenant and retail REIT trends

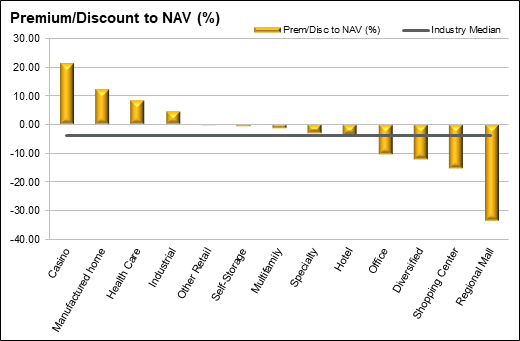

It is well known that continued sales growth of online retailers has challenged traditional brick-and-mortar retail operators and the underlying real estate. This is apparent from the recent slew of retail bankruptcies, including Toys R Us, Claires, Nine West, Bon-Ton Stores, and Southeastern Grocers, and the list keeps growing. Additionally, publicly-traded REITs at large have traded at discounts to NAV. The following chart highlights this, notably with the two most dislocated REIT sectors constituting multi-tenant retail (Power Centers and Regional Malls). Note that “Other Retail” in this context includes net lease properties and retail developers which have traded at or around NAV, skewed slightly by Realty Income Corporation, which trades at an approximately 20% premium to NAV, and includes 20% non-retail assets. Realty Income Corporation also has a comparatively large market capitalization of $15.8 billion.

AFIN’s portfolio includes three main property types: cold storage, power centers, and single tenant net-lease. AFIN owns 9 cold storage facilities, which probably should be spun off from the portfolio given that Americold Realty Trust (NYSE: COLD), a niche REIT in the cold storage space, has had a successful 2018 IPO and trades at a strong 4.5x book value). 30 retail power centers (from the merger with American Realty Capital – Retail Centers of America), with the remaining 519 properties consisting of single-tenant net lease properties. AFIN is centered on three distinct asset classes and would likely benefit from becoming more of a pure play by trifurcating along the cold storage, net lease, and multi-tenant asset properties.

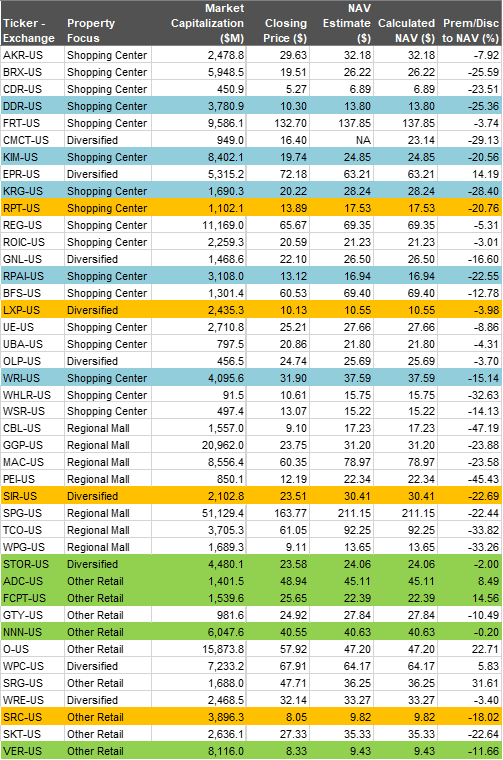

Note that in the following table, REITs highlighted in blue are identified by AFIN as peers in the multi-tenant market, and REITs highlighted in green are identified by AFIN as peers in the single-tenant net lease market. REITs highlighted in orange were identified by AFIN as peers that AFIN’s advisor incentive program is benchmarked to.

From this data we see that publicly-traded equity markets have largely battered retail REITs, with regional mall REITs getting hit most heavily. Importantly, a majority of AFIN’s designated peers, as highlighted above, trade at values below their estimated NAVs. AFIN, prior to the merger with American Realty Capital - Retail Centers of America, would likely trade in a more favorable range if not for the inclusion of so many multi-tenant portfolio assets. Therefore, it is not surprising that AFIN’s shares would trade at such a discount to its estimated NAV per share, or its book value per share. Additionally, many of the REITs listed above are internally managed, or have short-term advisory contracts, providing shareholders with the upside of prospective reductions in asset management costs over time. In contrast, AFIN has a 20-year advisory agreement that has options for long-term extensions. This effectively precludes AFIN shareholders from this potential upside as the advisory contract is locked in for the foreseeable future. I have not encountered any analysis that argues that such a long-term advisory agreement is beneficial to shareholders.

If these issues are so apparent, why did this listing occur?

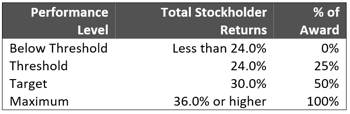

I would note the incentives that the advisor and affiliates of the advisor had that were put in place through the listing. These include a listing note that will pay the advisor’s affiliates in the event that AFIN’s stock performance, including distributions, exceeds all gross proceeds from the AFIN and ARC-RCA IPOs plus a cumulative 6.0% non-compounded return. This potentially could happen in the future, though not likely any time soon, given the current trading range. Additionally, AFIN reported that its board of directors had approved a multi-year outperformance agreement, the terms of which were reported contemporaneously with the listing of AFIN stock on the NASDAQ. The terms of the agreement allow for a maximum payment (in equity) of $72 million divided by the average closing price per share calculated as the average closing price from the 10 trading days prior to August 30, 2018. Based on the current stock price, this could result in approximately $5 million in equity compensation, and would be paid out in two ways. Half of the incentive is available based on total shareholder returns over a three-year period from the listing with the following hurdles and percentage of equity award:

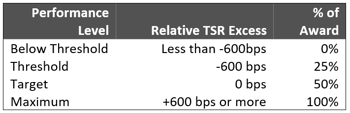

The second is through AFIN’s total stockholder returns compared to a peer group:

This second part is notable in that some degree of underperformance of AFIN relative to a selected peer group of Lexington Realty Trust, Spirit Realty Capital, Select Income REIT, and Ramco-Gershenson Properties Trust will still yield an incentive payment. This is truly paying for mediocrity.

What can investors expect or even do?

I expect that given the trading range, AFIN may attract a value investor shareholder base (MacKenzie recently tendered at $15 a share, and further discounts for the B-1 and B-2 shares) and possibly activists looking to push out current management. Other options would be for shareholders to meaningfully participate in corporate governance and take a scrutinizing look at the current board of directors, who also received enhanced compensation concurrent with the listing.