The newest craze in the world of digital assets, cryptocurrencies, and blockchain is non-fungible tokens (NFTs). NFTs are unique digital assets that represent tangible or intangible items. The tokens are used to provide verification of ownership over the assets and prove their authenticity and rarity. NFTs are the first digital signature that you cannot counterfeit and are run on a blockchain and stored in online wallets like other cryptocurrencies. A primer on NFTs can be found here at Forbes.

The collectibles market has become increasingly popular over the past few years as sneakers, sports cards, and Pokémon cards have brought an expanded audience into the space. The NBA is looking to capitalize on this trend with the release of NBA Top Shot. The NFTs in the case of NBA Top Shot are short video highlights that are sold through digital packs and vary in rarity/scarcity. Collectors can purchase as well as resell the highlights through the Top Shot platform, although they do not own the commercial rights to the highlights. Large influencers in the space include Mark Cuban and Gary Vaynerchuk, who have publicly backed NBA Top Shot and other NFT art platform projects.

Some of the early adopters of NFTs were artists who were attracted the ability to trace back ownership and prove the authenticity of the digital art, and likely the prospect of capitalizing on a greenfield at the nexus of art and blockchain technology. The Canadian musician Grimes (mother of X Æ A-Xii), recently sold $6 million worth of……interesting……digital art on Nifty Gateway, an online marketplace founded by the Winkelvoss twins. It is unclear if her partner and sometime crypto enthusiast Elon Musk was one of the purchasers. The artwork sold ranged from one-of-one pieces to pieces with thousands of copies, with the most expensive piece selling for roughly $389,000.

Many believe NFTs are a way for artists and musicians to better capture the value they create and cut out the dreaded gatekeepers. Technology has been wonderful at disintermediation. Think about how Uber has cut out the taxi medallions gatekeepers or Warby Parker eschewing retail to bring lower costs to the end customer. If you are making money as an in-between, chances are your business may be disrupted by the disintermediating effects of blockchain technology.

Blockchain technology has come under scrutiny for its carbon footprint in recent years and most recently Ethereum in particular, which platform NFTs are built off. According to Memo Akten “one single-edition NFT has a carbon footprint equal to driving a petrol car for 1,000 km,” due to the fact that a single NFT can involve dozens of transactions including bidding, cancelling, as well as the sale and transfers of ownership.

NFTs could prove useful in other aspects including fighting identity theft, digitizing medical records, academic qualifications, or even storing things such as smart contracts.

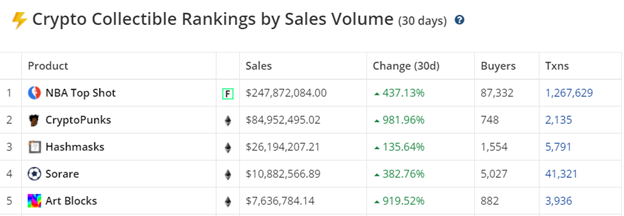

NFTs have seen robust sales into 2021. Over the past 30 days there have been over $375 million in NFT sales, according to data from Crypto Slam:

What are the major tailwinds of NFTs?

- Assets can be traced back to the creator and allows the purchase to be authenticated by other participants on the blockchain.

- NFTs cannot be divided into smaller denominations unlike other cryptocurrencies like bitcoin, and they cannot be exchanged with another NFT because they are unique.

- NFTs are transferable and preserve ownership rights by the use of decentralization on a distributed ledger, where no owner can alter the data on the blockchain.

- Cheap capital needs to find a store of value.

- Robinhood has trained people to be “investors,” aka speculators.

What are the setbacks for NFTs?

- If you lose your keys to your digital wallet, you may lose that asset forever.

- While assets can be put in “cold storage,” a typical transaction will still need the internet to facilitate a transfer, which may create security risks.

- Limited, two-year track record on the asset class.

- Unlike physical copies of art or card, digital copies can be an exact pixel match.

- Experience-based living may come back strong in a post-pandemic future.

NFTs are currently in their infancy and are mainly being used for collectibles. The tokens have many positive characteristics and may be useful in a large number of areas outside of their current uses. But for now, the tokens may just be a speculative mania of basketball highlights, digital cats, and CryptoPunks.

Contact Information:

Analyst

(612) 284-1116