Art. Is it just for eccentric billionaires or is it an asset class we can all be excited about? There are clearly people in the world with questionable taste and a lot of money—how else can you rationalize the sale of Peinture (Etoile Bleue), by Joan Miro, shown below, for $36.9 Million?

The Case for Art (as an investment)

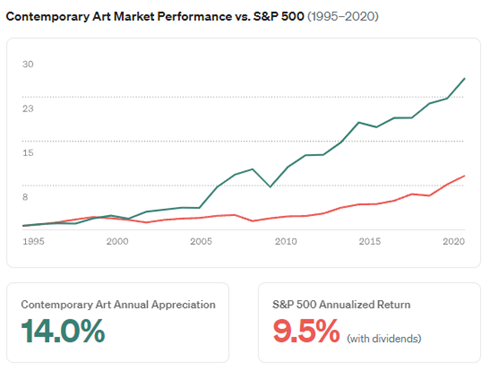

According to a comprehensive December 2020 report from the Citi Private Bank Global Asset Allocation Team, art as an asset class had a correlation coefficient of 0.12 with developed market equities from 1985 to 2020, Citi reported annualized appreciation of 8.3% across all art, further granulated into contemporary art (11.5%) and impressionist art (6.8%). Masterworks.io, an investment platform created to buy and sell shares in specific pieces of art, provided data on their website showing contemporary art has outperformed the S&P 500 annualized returns over the last 25 years with an annual appreciation rate of 14.0%, from an investor’s perspective, Basquiat may look better than Monet. Further, during 2020 art sales surpassed $50 billion, down just $14 billion from the year prior according to ARTnews. Citi’s report also highlights shifting consumer purchasing trends with approximately 10% of 2019 art sales occurring online and 37% of first half 2020 sales occurring online, undoubtedly enhanced by the significant disruption related to the COVID-19 pandemic.

Art is extremely fickle. A valuable painting is valuable not because you like the image but because other people like the image. The most beautiful picture in the world drawn by a nobody carries none of the intrigue of a van Gogh or Monet. Like everything in the world, it comes down to scarcity. For example, Rembrandt only painted one seascape, The Storm on the Sea of Galilee, and while it was stolen from the Isabella Stewart Gardner Museum in Boston in 1990, some still believe it was his best work. Perhaps the equation for a really treasured piece is: Dead Person + Limited Supply of Art x Challenging Life = Really Expensive Squiggles.

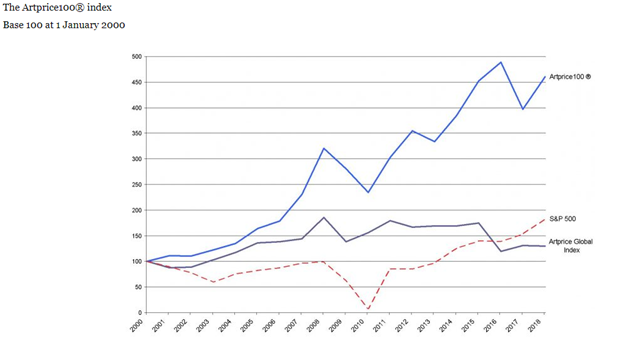

As an asset class, works from the most favored artists have higher annualized returns over the last 18 years than equities according to the Artprice100 index. The index tracks the top 100 artists in the market every year and takes their weighted average performance over the previous five years, as shown in the chart below.

Downfalls to Art Investing

There are a lot of questions surrounding the art market, including how much of the overall returns of art are driven by significant gains in a few concentrated prized pieces and artists? If you are lucky enough to acquire any of Picasso’s works, or even an interest in of Picasso’s works, you can guarantee yourself a win because the allure of this artist will likely not wane. But the price point to acquire such a blue-chip piece of art leaves few potential buyers. This is shown in Artprice100 index significantly outperforming the Artprice global index as shown in the chart above.

One of the most significant issues many investors have with the art industry is the lack of intrinsic value. It is hard for some to overcome the fact that price is what the market at the time determines and there are limited opportunities for generating income or cash flows or any reliable growth projections to determine future value.

Like other alternative asset classes, art is highly illiquid and investors should expect hold periods of 10 years or longer. However, Masterworks secondary market may enhance liquidity in this esoteric market. Asset selection is also hard for individual investors who are not art experts, making this market even harder to break into. Recently, platforms have made it possible for factional shares for of artwork to be purchased and sold on secondary markets, which has led to a broadening of the investor pool and potentially greater price transparency. As of May 2021, Masterworks had purchased over 40 pieces for approximately $150 million and plans to purchase over $400 million worth of art in 2021 and close to $1 billion in 2022, according to Artnet. The art market is more accessible now than ever before, offering potentially great returns and diversification but illiquidity, pricing transparency, intrinsic value all are risks in the art market.

While you may not get the fulfillment of seeing that masterpiece hang on the walls of your house, you may have the consolation of investing in an asset class that has shown some robust historical performance, which may allow for you to purchase some exquisite squiggles for your walls down the road.

Contact Information:

Analyst