Leveraged loans comprise a significant portion of the investment portfolios of many alternative investment products that FactRight reviews, including business development companies and more recently credit-focused interval funds. Recent trends in leveraged loan space include the resurgence of covenant-lite loans. Covenant-lite loans are loans that lack traditional protective covenants that may protect creditors in the event of borrower distress. These protections take the form of financial maintenance tests of the borrower which are reported periodically, usually monthly or quarterly, to the creditor. These financial maintenance tests may include EBITDA ratios and loan-to-value metrics, among others. Additional traditional covenants may restrict the borrower from issuing additional debt in certain situations and require interest rate increases to the creditor’s loans upon additional debt issuance by the borrower, as well as incorporation of any subsequent covenants the borrower is subjected to with other creditors. Other covenants may require percentage repayments to the creditor upon asset sales by the borrower. In the event the borrower’s performance recedes below certain thresholds contained in the financial maintenance tests, the creditor may take certain actions, including calling the underlying loan. The primary purposes of the covenants are to protect the creditor and allow the creditor to take actions, including calling the loan or liquidating the borrower, upon the occurrence of deterioration of the financial performance of the borrower. This mitigates risks that would subject the creditor to principal losses, helping to prevent the borrower’s financial performance from further deterioration or prohibiting the borrower’s management from taking actions adverse to creditors, including issuing dividends to equity holders, as early distress signs are exhibited. It is important to note that leveraged loan investors are typically subordinated, in the capital stack of borrowers, to financing from revolving lines of credits.

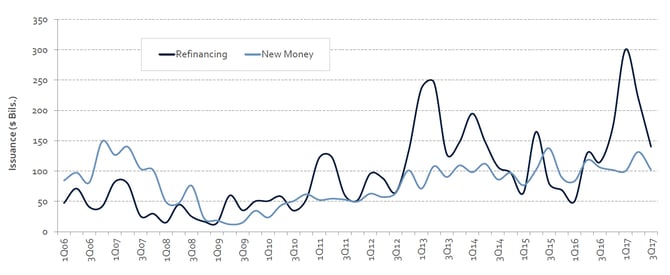

The following charts, from Thomson Reuters PLC, outline leveraged loan issuance over the past decade. Note the predominance of refinancing activity in 2016-2017.

U.S. Leveraged Loan Issuance 2006-2017 Q3

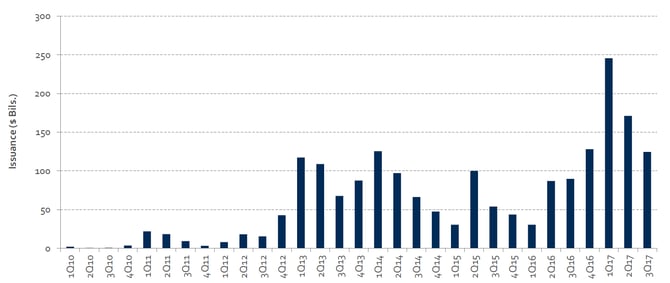

The following charts highlight covenant-lite issuance and the percentages of issuances that are covenant-lite. Note that issuances of covenant-lite loans exceed the new money issuances in the chart above. This may indicate that borrowers are refinancing previous issuances that may include covenants into covenant-lite loans. Moody’s notes that covenant-lite loans account for the largest share ever of the leveraged loan market. This erosion of creditor protections reflects the shift in the market from the immediate aftermath of the financial crisis, in which creditors tightened lending conditions, to the present, where increased competition from nonbank entities including hedge funds, private equity, business development companies, and more recently, interval funds, has created market conditions more conducive to borrowers. With increasingly diverse capital sources chasing the same pool of borrowers, covenants, as well as yields, have become casualties.

U.S. Leveraged Covenant-Lite Volume

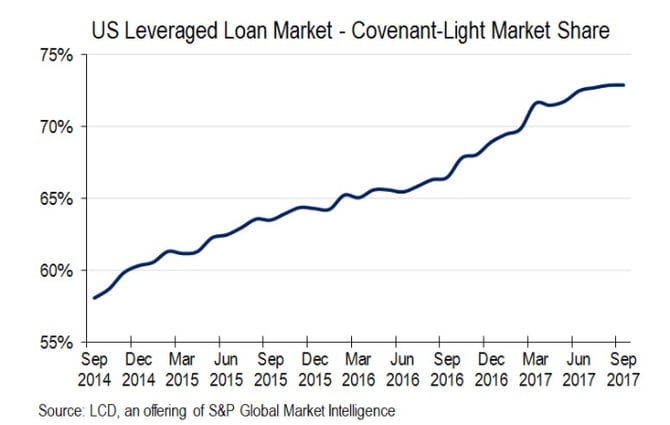

The demise of covenants in the leveraged loan market is accelerating, as noted in the following chart from S&P Global Market Intelligence. Historically, following defaults, senior secured leveraged loan creditors have realized recovery rates, in line with recovery rates for syndicated project finance bank loans, of approximately 80% (according to Moody’s data from 1983 to 2011). Moody’s recently forecast that recovery rates on recent vintages of covenant-lite loans may fall to approximately 60%. This increased downside risk, coupled with declining yields as the leveraged loan market has become more crowded, may fundamentally shift risk/reward calculations amongst existing and prospective credit investors.